Rising interest rates, combined with further tightening of credit availability appear to be dampening the enthusiasm of investors and first home buyers, says the latest report from Quotable Value.

'While house values continue to rise, what lies beneath QV's latest figures is growing evidence that price pressure has shifted from the lower valued properties popular with investors and first home buyers, onto the higher valued housing stock where buyers are less impacted by credit availability and affordability constraints,” the housing market organisation says in a statement released today.

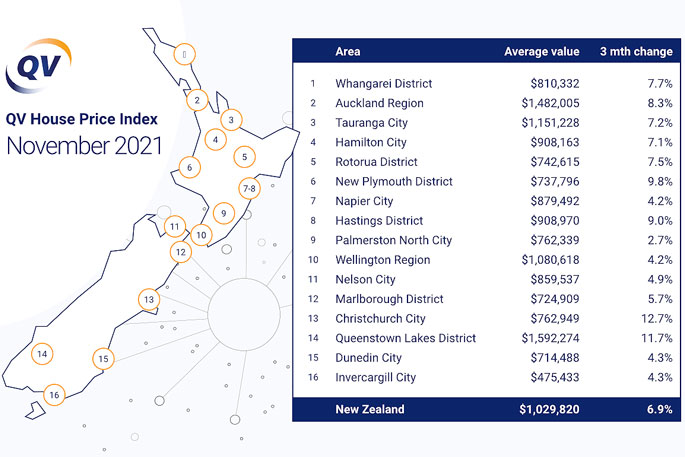

The average value increased 6.9 per cent nationally over the past three-month period to the end of November, up from the 5.3 per cent quarterly growth QV saw in October, with the national average value now sitting at $1,029,820.

This represents an increase of 28.4 per cent year-on-year, up from the figure of 27 per cent the organisation reported last month.

Tauranga's red-hot residential property market continues to blaze away, with home values rising by an average of 7.2 per cent this quarter − a small increase on the 6.6 per cent growth rate QV reported last month.

The average value of a home has increased by 33.7 per cent over the last 12 months to reach $1,151,228.

'Values continue to rise, properties are still selling well, and the number of appraisal requests is beginning to increase again as vendors want to list during summer when their properties are looking their best,” says QV property consultant Derek Turnwald.

'Investor interest from Auckland and Waikato remains low while prospective purchasers aren't able to travel here to view prospective properties.

'We expect to see that increase once the traffic light system is introduced and border restrictions are eased. Anecdotally, agents tell us that many disgruntled Aucklanders are very keen to leave the city after being locked down for such an extended period.”

Meanwhile, Derek says rising interest rates and more stringent lending criteria had shut many first-home buyers out of the market altogether.

'Investors seem to have lost enthusiasm as well, due to changing tax laws and increased LVRs making the market less appealing.”

Image: QV.

Image: QV.

In the Auckland region, the average value now sits at $1,482,005, climbing 8.3 pre cent over the last three-month period, with annual growth of 27.9 per cent − even higher than October's year-on-year growth of 24.8 per cent.

'While the November numbers look extremely bullish there are growing signs that this property growth cycle is starting to transition,” says QV general manager David Nagel.

'Real estate agents are reporting a significant upswing in listings, while open home attendance rates are falling.

'Some properties are being passed in at auctions, which was unheard of a few months ago.”

David says this isn't a surprise given rising interest rates, changes to LVRs last month and now a further tightening of credit rules from December.

He says this has taken a number of buyers out of the market, just as stock numbers are starting to increase, which is resetting the supply demand equilibrium.

'A dozen of the 16 major urban areas we monitor have still recorded an increase in the rate of growth for the QV three-monthly house price index.

'But this is more a result of price pressure at the top end of the market, which generally has a different type of buyer, with less credit restrictions or affordability constraints.

'We've broken the market down into quartiles to better understand which properties are showing the biggest increases in value.

'In almost all cases the greatest price increases were occurring in the top 25 per cent of properties by value. In many cases, this was significant.

'Take Palmerston North, for example, which has experienced massive price growth this year, but is now down to just 2.7 per cent three-monthly growth overall. But the top 25 per cent of properties are showing 6.3 per cent value growth.

'In Dunedin, one of the hottest markets earlier in the year, values have grown by 4.3 per cent over the past three months, but the top 25 per cent of properties are showing value growth of 9.6 per cent over the same time. This indicates a change from what we were seeing previously.”

The strongest overall three-monthly value gains for the main cities have come from Christchurch at 12.7 per cent growth in value, up from 10 per cent value growth last month, followed by Queenstown Lakes District at 11.7 per cent growth, building further on the strong three-monthly rate of growth of 9.6 per cent QV reported last month.

None of the 16 major urban areas QV monitors have seen a decline in average value, with all but Palmerston North (2.7 per cent), Napier (3.7 per cent), Nelson (4.9 per cent) and Invercargill (4.3 per cent), showing an increase in the rate of three-monthly growth since last month.

The Canterbury region has experienced the strongest annual value growth with 36.2 per cent growth over the past year, followed by the Hawke's Bay region at 33.9 per cent, while the Taranaki and Manawatu-Whanganui districts have both experienced annual growth of 33.2 per cent.

The three lowest annual growth rates are all in the South Island, with the Southland region experiencing a still-significant 20.3 per cent increase, the Tasman region recording 22.6 per cent growth, and Otago at 23.7 per cent annual growth.

0 comments

Leave a Comment

You must be logged in to make a comment.