Tax brackets might have shifted, but the savings are barely scratching the surface of the inflation that has hit households over recent years.

It was confirmed on Thursday the government will go ahead with the tax bracket adjustments National outlined before the election.

It will also change the eligibility for the independent earner tax credit (IETC) so that it applied to people earning up to $70,000 rather than the current $48,000 and increase the in-work Working for Families tax credit by $25 a week.

But the income at which Working for Families credits start to be clawed back will not change, nor will the rate at which that happened.

As signalled, families with children in early childhood education will also receive a subsidy of up to $75 per week if they earn up to $140,000, reducing to $18.75 for households earning $170,0000.

Finance Minister Nicola Willis says it's the first tax relief in 14 years - but commentators say it does little to address the rising costs that households have faced over that time.

Using scenarios that RNZ developed earlier in the week, the government's calculator shows households will be in for tax savings ranging from 0.65 per cent of annual income through to more than 5 per cent, influenced in part by whether a household paid for early childhood education.

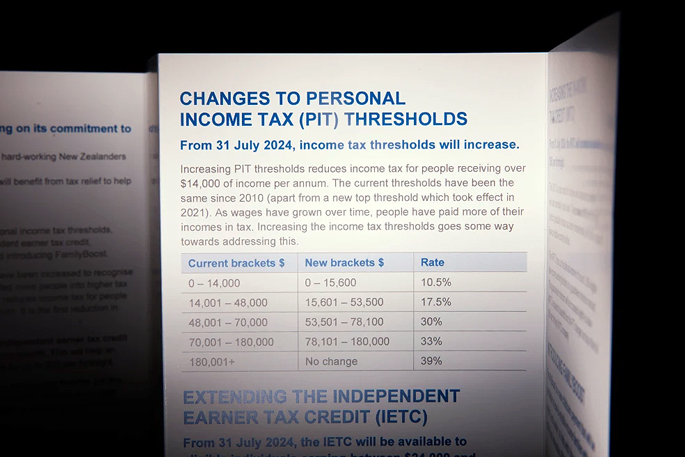

The new bands mean that the 10.5 per cent tax rate applies on income to $15,600, while the 17.5 per cent tax rate will apply to income between $15,601 and $53,500.

The 30 per cent rate will apply between $53,501 and $78,100, the 33 per cent rate between $78,101 and $180,000 and the 39 per cent rate will still apply to income above $180,000.

But if the rates had been adjusted for the inflation that had happened since they were set in 2011, the 10 per cent rate would apply to income up to $18,976, the 17.5 per cent rate to income between $18,977 and $65,061, the 30 per cent rate to income between $65,062 and $84,881, and the 33 per cent rate to income between $94,882 and $213,539.

The 39 per cent tax rate would not start until income hit $213,540.

Even if the rates had been adjusted for inflation only since 2017, the tax thresholds would have been higher - 10 per cent tax on income up to $17,7378, 17.5 per cent for income between $17,739 and $60,816, 30 per cent for $60,817 to $88,690, 33 per cent for $88,691 to $213,539 and 39 per cent for income over $213,540.

Independent economist Shamubeel Eaqub says the cuts are probably only taking households back to where they were three or six months ago.

"It's quite wrong to make these band adjustments political. We should not have to pay for inflation. It's been dressed up as a tax cut, but is it really?"

Photo: RNZ.

Photo: RNZ.

Tax expert Terry Baucher says households at the lower end of the income scale will probably feel the impact.

"At the lower end, where every penny counts, they'll be grateful but it will go straight away on just paying the bills or paying down debt."

He says the change doesn't come close to covering recent inflation.

The Working for Families threshold for clawback of credits is "way too low", he says: "The poorest people are paying for tax cuts for the landlords. If you're saying a family income of $42,700 is sufficient, in what year?"

Infometrics chief forecaster Gareth Kiernan says the bracket shifts might unwind the impact of 12 to 18 months of price increases.

"You could argue National, when it put the tax brackets in place in 2011, was not getting enough revenue and underinvesting in the economy. But the reality is that the last six years the government has grown substantially and we're faced with a period where there is no additional spending in the next four years to try to bring things back under control."

Robyn Walker, a tax partner at Deloitte, says it was a pleasant surprise to see National stick to its tax plan, given recent commentary around fiscal conditions.

She says it will be nice to see some commitment to regular indexation of tax bands to income in future Budgets, "to prevent the same issue happening again".

Here's what the cuts might look like for a range of households

Single parent, two children (aged 3 and 5), part-time net income of $30,000, no childcare fees

This household would receive a tax cut of $1,412 a year, or $54.31 a fortnight according to the government's calculator.

This household's expenses have increased by 21.54 per cent since the first quarter of 2020, and income has not kept pace in dollar terms. The tax cut represents a 4.7 per cent increase to household income.

Two adults, one full-time income of $67,000, two children (aged 6 months and 3 years), paying $100 per week for childcare

This household would receive a tax cut of $3,399.50 a year.

The household's expenses are up 21.62 per cent from the first quarter of 2020, while the tax cut and childcare credit represent a 5.07 per cent boost.

RNZ's data shows wage rises in this bracket have not kept up with inflation in dollar terms.

Two adults, one full-time on $65,000, one part-time on $29,000, two school-aged children, no childcare fees

This household has had a 23.31 per cent increase in expenses since the first quarter of 2020.

Their tax cut will be $2,211.50 a year - a 2.35 per cent increase to take-home income.

RNZ's data shows this bracket's wage rises have been slightly ahead of their increase in expenses - but this depends a lot on how much debt they are carrying.

Two adults earning $120,000 and $78,000, one non-earning adult and three school-aged children, no childcare fees

This household's expenses have risen 23.69 per cent since the start of 2020 and their annual tax cut will be $2,082 or 1.12 per cent.

Wage rises have outpaced expenses on average for this income group.

Single adult on $160,000 full time

Expenses are up 23.95 per cent since the first quarter of 2020 in this scenario, but their $1,042.50 tax cut is only equal to 0.65 percent of income.

This bracket has had wage rises that have kept ahead of inflation.

4 comments

Good Job

Posted on 31-05-2024 09:32 | By Yadick

IMO they've done a very good job with this 'no-frills' budget. They could only promise on what they had been led to believe from Labor but when finally opening the books to reveal such a mega mess would have been crippling. If this is a woefully bad budget then Labor is to blame due to lies and deceit.

Onwards and upwards New Zealand . . . together.

Good Effort

Posted on 31-05-2024 12:52 | By JimmyH

She didn't have much to work with, no thanks to Labour, Nicola did the best she could with what she has. Unsure why all the sheep are out, slaves to TPM is my guess

Dont like it much

Posted on 01-06-2024 09:43 | By Alfa male

No, I don’t like it much, but then what else do you do when the previous govt left the cupboards bare. It took courage to present this budget, it will take courage to stay on course. I still don’t like it much, but I am glad you’ve done it.

Whingers.

Posted on 02-06-2024 13:57 | By morepork

The Government kept it's promise and most of us will get some Tax relief. I, for one, am glad (and grateful). But, politically, whatever they do will not be enough. Unless they offered a handout that would cancel inflation and pay all your bills (ironically, that would be highly inflationary...), then they haven't done enough. Anyone who doesn't support the Government is going to whinge (and also quite a few who DO support the Government, as well). Instead of seeking to blame someone previous or present, why not just be glad you have a few bob extra and stop whining?

Leave a Comment

You must be logged in to make a comment.