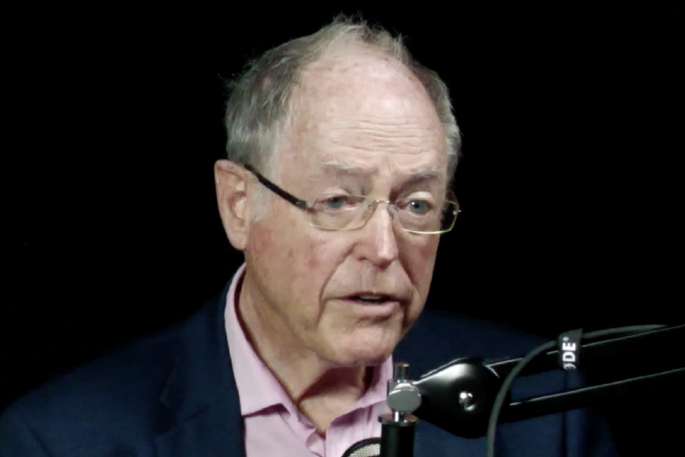

Economist and former politician Don Brash returns to this week's ‘Future Buzz' podcast to discuss the risks and failures of New Zealand Superannuation.

This information packed podcast tackles the increase of the retirement age, ensuring a sustainable future with Superannuation, along with solutions to some of the 'failures” associated with the current policy.

Brash is joined by producer and host Ross Crowley to discuss.

'On both sides of politics, Government's have been reluctant to face this issue,” says Brash.

'The population is aging, the birth rate has fallen beyond replacement levels in New Zealand, the United States, China and Japan. The consequence is the population is getting older.

'This means there are fewer people earning money, and more people drawing down their savings and asking for taxpayer support through healthcare or through super annuation.

'Both healthcare and New Zealand super have been more sustainable in the past when we had more taxpayers paying into the scheme and less people drawing out of the scheme.

'This means, if we leave our Superannuation as it is, future Government's will get more and more into debt.”

Brash adds New Zealand is unlike many countries, and does not rely on a 'pot of money” to pay for the superannuation scheme, rather the Government 'pays as we go”.

The low debt approach to spending is due to Ruth Richardson's Fiscal Responsiblity Act according to Brash, who says the act made New Zealand Government's accountable for their spending in the future as well as the present, and has allowed the Government to run at a surplus in many prior and following the Global Financial Crisis.

People are also living longer along with the declining birth rates according to Brash, who says when a pension was first put into place in New Zealand, it was in line with the life expectancy.

'Once upon a time, in 1898 or a very early stage [in New Zealand] you became eligible for the old age pension was about life expectancy at the time.

'Not many people got to the point of drawing that down. Now, life expectancy is in the low 80s, and many people are now living longer than that. You can be getting New Zealand Super for 20 years before that, and that's a large chunk of cash.”

Brash says it is 'quite reasonable” to move the superannuation year gradually starting in about 'two or three years time, from 65 to 68”.

'Perhaps then [the Government] can higher the level of eligibility to life expectancy.”

According to Brash, Government's tend to turn a blind eye to this issue as it is an issue that will impact the country long term, and most taxpayers are reluctant to see an increase.

For more information on Brash's perspective on the 'failures and risks” of superannuation, visit the full-episode on the Buzzworthy website.

1 comment

Needs to be phased in, for sure!

Posted on 19-10-2022 09:34 | By The Professor

If any Government is going to be brave enough to increase the retirement age, then they need to introduce it with plenty of warning. In my opinion they should for example state that for anyone who is aged 16 as of the 1st January 2023, the retirement age will be 67. It would be unfair to introduce it to anyone who is already in the 'work stream'.

Leave a Comment

You must be logged in to make a comment.