Home values continue to climb ever higher in Tauranga – but there are increasing signs of a slow-down on the horizon.

The city's average home value increased by 30.5 per cent in the 12 months of 2021, including 7.7 per cent in the three months leading into the Christmas and New Year holiday period. It is now sitting at precisely $1,173,369.

"The Tauranga residential market performed strongly in 2021 with high buyer confidence, continued low interest rates early in the year, and an economy which, despite the uncertainty created by Covid-19, is performing comparatively strongly," says QV property consultant Derek Turnwald.

"The population of the city is growing rapidly and a large number of new dwellings was built on the periphery of the city, particularly in Pyes Pa and Papamoa.

"Changes to tax laws pertaining to property ownership – particularly for investors – and rising interest rates in the latter part of the year has dented that confidence in the market. Though properties continue to sell well and values continue to rise, the sentiment is that the residential market is likely to cool off in 2022."

Turnwald says the number of open home attendees had already dropped off considerably.

"The market quietened down more than usual over the Christmas and New Year period. Bank lending continues to tighten and first-home buyers are finding it harder and harder to get lending approved. Mid-to-high value range properties continue to sell reasonably well, but the numbers of prospective buyers looking to purchase has decreased."

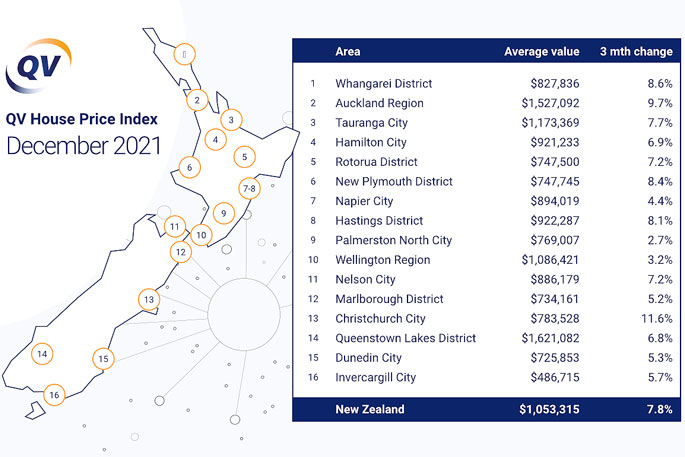

The average home increased in value by 7.8 per cent nationally over the past three-month period to the end of December, up from the 6.9 per cent quarterly growth we saw in November, with the national average value now sitting at $1,053,315.

This represents an average annual increase of 28.4 per cent for 2021.

In the Auckland region, the average value now sits at $1,527,092, climbing 9.7 per cent over the last three-month period, with annual growth of 29.1 per cent, increasing from the 27.9 per cent QV reported in November.

"It is fair to say that 2021 was a pretty unusual year for the property market. Never in recent times have we had so much external intervention in a housing market and yet, in the midst of a global pandemic, the market grew by a record 28.4 per cent nationally," says QV Operations Manager Paul McCorry.

"It became pretty clear towards the end of the year that this level of growth was not going to continue indefinitely as we started to see a decline in the quarterly rate of growth."

Last month, QV reported that three quarters of the major urban areas we monitor were still seeing an increase in the rate of quarterly growth.

This time around, half are now showing a decline.

"To be clear, they are all still seeing values go up – but at a much slower pace.

"Of the other half that are still showing an increase in the rate of growth, five have increased by less than one per cent. The market has definitely pumped the brakes, but it hasn't ground to a halt completely."

McCorry says Christchurch City was the obvious winner of the unwanted ‘biggest increase' title in 2021.

The Garden City saw values lift a staggering 40.2 per cent year on year, "a symptom of a market a little earlier in the growth cycle, where relatively speaking things were a little more affordable".

In real terms, that means in January 2021 the average Christchurch house price was around $560,000; today it is $785,000.

Whilst the rate of growth has slipped a little this quarter, it is still in the double digits over a three-month period at 11.6 per cent.

"Aucklanders have been doing the hard yards for the rest of Aotearoa throughout 2021, moving through the various lockdowns and traffic lights.

"After over 100 days in lockdown it is no surprise to see the Super City catching the wave of a now internationally recognised trend – a post lockdown boost to the property market, up 9.7 per cent over the quarter.

"A prolonged period at home and now a relaxing of these restrictions will have people taking stock of their living arrangements."

At every summer barbeque the conversation will have inevitably turned to what the market will do in 2022, but McCorry says predictions can be fraught with danger.

"Following the March 2020 lockdowns, doom and gloom was rife with predictions of a market correction.

"Yet since March 2020 values nationally have increased almost 41 per cent. So what do the next 12 months have in store? Inflation and the interaction with interest rates will be key."

The Reserve Bank of New Zealand measures the average increase in the cost of goods and services and aims to keep that rate of price inflation between 1-3 per cent. The third quarter result was 4.9 per cent – so considerably higher than expected.

"The most likely lever to reduce this rate going forward is to increase the Official Cash Rate (OCR), which in turn increases interest rates banks will offer to prospective homeowners.

"We saw successive increases in the OCR in October and November, and it is no surprise that this was when we started to see the tide turn a little in the rate of growth.

"At this point in time, despite these increases, interest rates are still considered low by historic standards and this has most likely prevented the market being absolutely stuck in the mud. But any more increases could start to make both banks and their borrowers feel pretty nervous.

"More rigorous lending criteria that came into effect in December will also have banks really scrutinising every application."

Meanwhile, in recent months we have seen quite a flood of listings to the market, mainly as people tend to hold off putting their home up for sale until the good weather. With increased listings, buyers have more choice.

"They won't attend every open home and you won't get as many multi-offer situations. The chatter about properties being handed in at auction is real, as is property sitting on the market beyond the initial tender period – often re-listed with an asking price. Managing vendor expectations coming out of 2021 and into 2022 will be a very advantageous skill set for an agent.

"If we had to draw a line in the sand, you could reasonably expect values growing in the smaller single digits towards the middle of the year and potentially remaining stable throughout winter, but 12 months is a very long time in a property market and realistic pricing and realistic vendors will prevail in 2022."

0 comments

Leave a Comment

You must be logged in to make a comment.