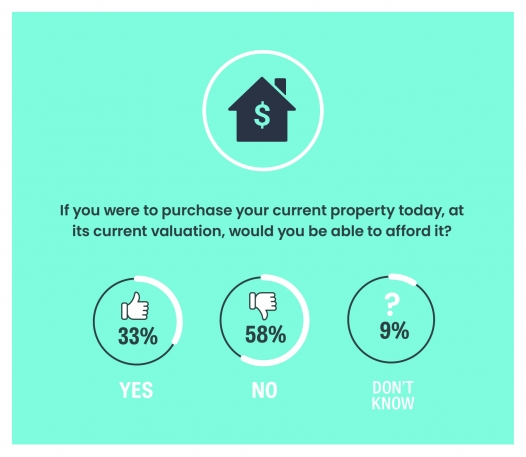

Three out of five property owners could not afford to buy their home at its current value, according to the latest survey from Consumer NZ.

Consumer NZ's Sentiment Tracker has found three out of five property owners would be priced out of the property they own if they had to purchase it at its current valuation.

Those aged 60-69 were least likely to be able to afford to buy the property (66 per cent), followed by those aged 50-59 and those 70+ (59 per cent).

About half of those aged 18-29 would still be able to afford their property.

"Our runaway housing market has solidified New Zealand as a country divided by property wealth. If you don't have a foot on the property ladder, the dream of owning your own home is becoming increasingly unlikely. At present, the average house price is more than 12 times the average national income," says Consumer NZ head of communications and campaigns Gemma Rasmussen.

'We asked New Zealanders what their biggest concerns are at present, and from both a national and financial perspective, the answer was housing. It exceeded concerns about Covid-19, as well as the cost of electricity and food. Regardless of whether you own a home or are renting, New Zealanders are deeply concerned about the state of housing."

James, a registered electrician from Whangārei purchased his home for $450k in 2018. Since then, the property's capital gains have outstripped both his and his partner's combined annual salaries.

'We really lucked out getting into the housing market when we did. Between the two of us we had 30 years of combined KiwiSaver – and some savings on top of that. When we bought the house, it was a massive relief that we wouldn't be beholden to a landlord. It's offered us peace of mind. If we'd acted a few years later, our home purchase would not have been possible.”

The Sentiment Tracker also asked New Zealanders who didn't own property how they felt about their chances of purchasing a property.

Forty-two per cent felt completely locked out of the market.

Twenty per cent said they're saving for a deposit but can't catch up.

The Consumer NZ Sentiment Tracker

The Consumer NZ Sentiment Tracker is a nationally representative body of data that grows by more than 1000 respondents every three months. Tracking everything from environmental awareness and financial sentiment to general levels of trust for major industries – it looks to provide a holistic understanding of how New Zealanders feel about a range of issues.

To learn more about the Sentiment Tracker and the state of the New Zealand housing market, check out episode one of Consume This, the podcast exploring the big issues, hosted by Jon Duffy and Sophie Richardson.

1 comment

...

Posted on 08-09-2021 10:54 | By B.C.

Why on earth has the billionaire Larry Page just been granted NZ citizenship? How does that benefit the average Kiwi? It doesn’t. It’s either corruption or incompetence. These filthy rich people could be granted extended visitor visas which might actually assist our economy, but no, we’ll let them waltz on in and buy up the place. This could have been stopped 10 years ago, but now it’s too late. Thanks for nothing Labour and National!

Leave a Comment

You must be logged in to make a comment.