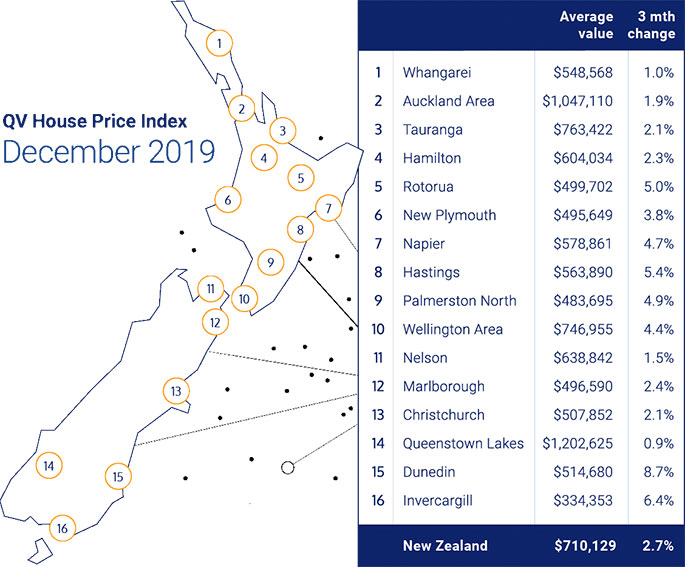

The latest QV House Price Index data for December shows the property market has finished the year with a show of strength, with all the 16 major cities monitored, including Tauranga, showing quarterly value growth.

This is the first time this has occurred since November 2018.

The average value nationally has increased 4 per cent year on year and is now $710,129.

This represents an increase of 2.7 per cent over the past three months.

The average value in the Auckland Region sits at $1,047,110, up 1.9 per cent over the last quarter, but down slightly by 0.1 per cent year on year.

'Affordability has been a continuing issue for buyers throughout 2019 due to the unprecedented value growth over the past five years,” says QV general manager David Nagel.

'But a combination of record low interest rates, as well as a shortage of property listings has created a welcomed boost to value levels for vendors as the year closed out.

'The regions have continued to thrive throughout 2019 while the markets of the main centres lost steam.

'But even the main centres have shown renewed strength in the past two months. The Auckland area has for the second consecutive month experienced quarterly value growth in all the legacy council districts.

'Financial providers are reporting renewed interest from existing property owners looking to restructure their financial position to enable the purchase of an additional property,” says David.

'First home buyers also appear to have adopted the sentiment that the timing isn't going to get any better in the short term to enter the property market.

'This means we have multiple buyers looking to purchase a limited number of properties, particularly at the less expensive end of the market. While affordability is still a concern for buyers, this is offset partially by the low interest rates, which appear to be here to stay for the medium term.

'Looking towards 2020, we will likely see a continuation of modest but steady value growth throughout most of New Zealand, at least until some of the new stock currently under construction comes on stream.

'But the property market hates uncertainty and with a general election looming later this year and no clear outcome on the horizon, housing policy will be key as we head towards the final quarter of 2020.”

Auckland

North Shore values dropped -0.9 per cent in the year to December but rose by 2.4 per cent over the past three months. The average value there is now $1,201,420. The former Auckland City Council central suburbs increased 0.9 per cent year on year and 2.4 per cent over the past three months and the average value there is now $1,244,959.

Waitakere values dropped by 0.2 per cent year on year, rising 1.0 per cent over the past three months.

Manukau values decreased by 0.5 per cent year on year, rising 1.8 per cent over the past three months; Papakura values increased 2.1 per cent year on year and 2.8 per cent over the last quarter and the average value there is now $716,121; Franklin values increased by 0.5 per cent year on year and Rodney values were down 0.7 per cent year on year.

The Auckland market rebounded for a relatively strong finish to 2019 after a downbeat first half of the year off the back of some uncertainty around government policy and the effect of the foreign buyer ban.

'The latest QV House Price Index figures indicate a slight lift in values across most areas with talking points going into the holiday break being a lack of listings and an increase in competitive situations for buyers,” says QV senior consultant Rupert Yortt.

'This led to good prices being achieved and a noticeable return of investors into some areas of the market.

Hamilton

Hamilton City home values increased by 2.3 per cent over the past three months and increased by 5.8 per cent in the year to December 2019.

The average value in Hamilton is now $604,034.

'Grandview Heights had the highest 12 month change in values up 7.6 per cent whilst Queenwood had the lowest at only 1 per cent,” says QV senior consultant Jarrod Hedley.

'Regionally all districts showed similar increases between 4-8 per cent for 2019 with the exception being Otorohanga increasing 29 per cent now up to $381,820.

'Thames Coromandel continues to have the highest median price for the region at $778,319.”

Tauranga

Modest value growth was seen in Tauranga with values increasing by 2.1 per cent over the last quarter.

The average value is now $763,422 up 5.9 per cent year on year.

Wellington

Values across the whole Wellington Region rose 5.3 per cent in the year to December and increased 3.5 per cent over the past quarter and the average value is now $856,272.

Porirua has lead the way in recent months with an increase of 6.6% over the quarter and an average value of $652,213.

The second half of 2019 finished strongly with values throughout the region continuing to rise.

'The value increase over 2019 was supported by low interest rates, limited stock and strong buyer demand across most segments of the market,” says QV senior consultant David Conford.

'First home buyers continued to have a strong presence in the market throughout 2019 and the latter half of 2019 saw increased activity from investors.”

A considerable number of townhouses were constructed throughout the region over the year and these have sold extremely well with demand continuing to outweigh supply.

A shortage or rental accommodation combined with population growth saw rents move higher over 2019.

'There was, and continues to be a severe shortage of rental accommodation in Wellington and many people struggled to secure accommodation in 2019,” says David.

'Looking forward to 2020, the key drivers - low interest rates, population growth and a relatively strong economy remain similar. Based on these drivers, we can expect a robust market in the first half of 2020 with upwards pressure on values likely to continue.”

David expects new listings will be few and far between until after Wellington anniversary weekend when most people will be back after the holiday period.

'New stock will come to the market over February and March in greater numbers however demand is expected to exceed supply and stock levels are likely to remain constrained, as they were in 2019”.

0 comments

Leave a Comment

You must be logged in to make a comment.