The New Zealand property for sale market looks set for a warm winter, according to the latest Trade Me Property Price Index.

In April, average asking prices climbed to a record high of $585,000, rising 2.1 per cent since last month, and up 8.4 per cent on a year ago.

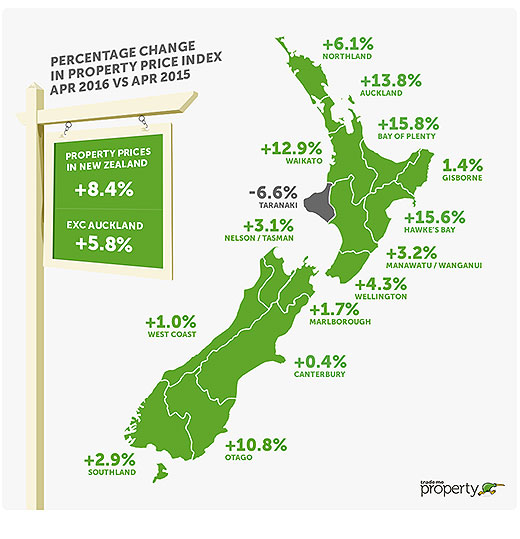

House prices in the Bay of Plenty have increased by 15.8 per cent.

Head of Trade Me Property Nigel Jeffries says house hunters should expect to pay a 'significant chunk more” when compared to this time last year.

'It's not good news for those looking to get into their first home with average asking prices up more than $45,000 over the last 12 months.

'On the other hand, sellers are in good stead as the reignited market continues to burn up.”

The average asking price of a typical New Zealand property has leapt 46 per cent over the last five years, from $402,150 in 2011 to $585,000 – an increase of more than $36,000 per annum. 'Since April 2011 the average asking price is up almost 50 per cent and the increase of $36,000 is pretty close to the median annual wage after tax in New Zealand,” says Nigel.

'That shows properties are now earning more than the median amount earned by a Kiwi employee. It's good news for property owners but a serious challenge for those aspiring to get a foot on the property ladder.”

Strengthening property market outside of Auckland

Several regions surpassed Auckland in year-on-year growth in average asking prices, with Bay of Plenty leading the pack, up 15.8 per cent in April to a new record high of $522,400.

'We saw average asking prices boosted by more than $70,000 over the past 12 months in the Bay, again way ahead of the typical salary in the region,” says Nigel.

'Over the past five years, average asking prices in the Bay have risen 37 per cent, with the lion's share of this over the last two years when more than $100,000 has been added to the average asking price.”

The Waikato market continues to respond to the 'halo effect” of Auckland's boom, with a 12-month rise in asking prices of almost $50,000, landing at $434,850.

'Auckland's market continues to make waves on nearby regions. In the Waikato, we've seen an increase in average asking price of 13 per cent compared to a year ago, pushing the five-year increase up 24 per cent,” he said.

Other regions with significant increases in average asking prices over the last 12 months were the Hawke's Bay, up 15.6 per cent to $471,750, while Nigel says Otago had seen 'a noticeable rebound” from early last year where prices fell for eight consecutive months.

'Since January, the average asking price in Otago has ticked up 11 per cent to $443,900 in April – a positive turnaround considering how unsettled things were at the start of 2015.”

Taranaki was the only region with a year-on-year slip in average asking price in the three months to April, down 6.6 per cent to $355,250 but ahead of its low point of $318,250 in December last year.

2 comments

Yay!

Posted on 10-06-2016 15:57 | By How about this view!

All of my hard work at school and work is paying off...... And I have never had to put my greedy hand out for free money

What crisis?

Posted on 11-06-2016 06:21 | By maildrop

Clearly there are plenty of opportunities to "get on the ladder". The problem is too many of Gen Y want to get on half way up it. You can't have cars, cigs, mobile plans, $5 coffees every 5 minutes and either save or pay a mortgage. Sacrifices have to be made to buy a home. Stop whining about the market and expecting another handout from those who made sacrifices when they were younger and in the same position.

Leave a Comment

You must be logged in to make a comment.