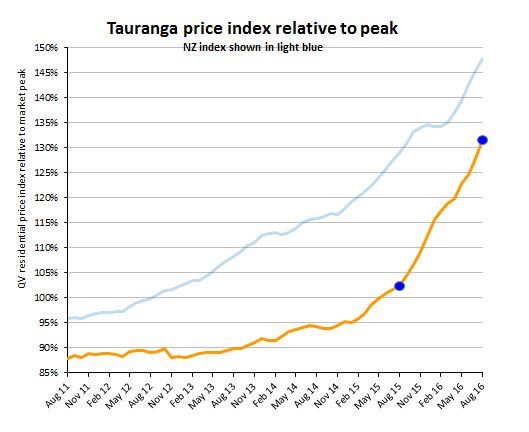

The Bay of Plenty is one of six regions where property prices hit a record high over August, according to figures released in the latest QV House Price Index.

The average house price in Tauranga is $633,638, showing an increase of 28.5 percent since last year.

By contrast, the average value nationwide is $612,527, $20k less expensive than prices right here in Tauranga.

Inner-city property is only slightly faster-growing than the surrounding Western BOP, which experienced a 26.3 percent increase to average value $557,640.

QV homevalue Tauranga registered valuer David Hume says the new lending laws may influence future growth.

'There've been indications from brokers, lending institutions, and real estate agents that the new LVR restrictions, requiring 40% equity for investors, are starting to have a cooling effect on the Tauranga and Western Bay of Plenty markets.

'Investors now need twice the equity they did five weeks ago and it appears they are taking a ‘wait and see' approach as they come to terms with the new restrictions, and the speed of their implementation.

'There are still a number of first-home buyers and pre-approved purchasers in the market driving demand.

'It's too early to tell what effect the new LVR restrictions will have on the market in the medium term and on values, but it's unlikely the Bay of Plenty will see similar levels of growth in the coming year to that witnessed over the last 12 months.'

The figures show that nationwide, residential property values for August have increased 14.6 percent over the past year, and are now nearly 50 percent higher than the previous market peak of late 2007.

When adjusted for inflation, the nationwide annual increase drops slightly to 14.2 percent, and values are 25.6 percent above the 2007 peak – a perhaps even more significant measure of the industry's unprecedented growth.

The Auckland market values are now 85.5 percent higher than the previous peak, or nearly 60 percent higher when adjusted for inflation.

The average value for the Auckland Region has now ticked over the one million dollar mark and is $1,013,632.

The average asking prices for homes across New Zealand in August. Photo: Supplied.

QV National Spokesperson Andrea Rush says there was a strong surge of activity in June and July.

'However, it now appears the new LVR restrictions for investors adopted by banks towards the end of July have started to have an impact in the housing markets in Auckland, Tauranga and Hamilton.”

'In recent weeks there has been a drop off in market valuation requests, auction clearance rates, open home attendees and loan application rates in these centres.”

'The Wellington market however continues to see strong growth with values there increasing at a faster rate than the Auckland region over the past year and the Dunedin market also continues to show strong levels of activity and demand.”

'Some regional centres have also seen significant value growth of more than 25.0% over the past year including Whangarei, Rotorua and Queenstown.”

And at an average of $557,640, Western Bay home prices are a decrease from the national average asking price of $612,527, says realestate.co.nz CEO Brendon Skipper.

'I think it's still a good place to invest in property – there's a lifestyle here,” says Brendon.

'You can't be as picky as you used to be, but it still offers some very good opportunities for a first home.”

Low levels of housing stock in regional areas such as Coromandel and Central Otago continue to drive up prices and leave the property market firmly in the hands of sellers.

'Nationally, it means that if no new listings were to come to market, all the existing properties in New Zealand would be sold in 14 weeks,” says Brendon.

The property demand is attempting to be met by the building industry, with the cost of building a home seen as more affordable.

Buying or building smaller town houses and apartments is also expected to become more of a popular option, says Brendon.

'The quarter-acre dream is slightly less obtainable than it was ten, or even five, years ago.”

The affordability of houses will continue to be an issue for families looking to buy a home, while those with a property are happy their investment has grown, says Brendon.

'There are certainly people that could have afforded a home ten years ago who might not be in that situation now.”

1 comment

Wait for the crash

Posted on 18-09-2016 17:22 | By BullShtAlert

Just waiting for all these housing speculators to get wiped out when values inevitably drop and interest rates rise.

Leave a Comment

You must be logged in to make a comment.