The average asking price of a typical Bay of Plenty property has risen $101,250 in the past 12 months to land at $533,600 in May and surpassing Auckland's lift of $95,100, according to the latest Trade Me Property Price Index.

Head of Trade Me Property Nigel Jeffries says the Bay of Plenty has seen 'rocket-fueled growth” for the past year as a flow-on effect of Auckland's property market.

The average asking price for a property in the Bay is now at $533,600.

'The City of Sails has been propelling the property market forward at real pace for the better part of three years, consistently exceeding $100,000 in year-on-year growth. In the last 12 months, average asking prices there have lifted by almost 13 per cent.

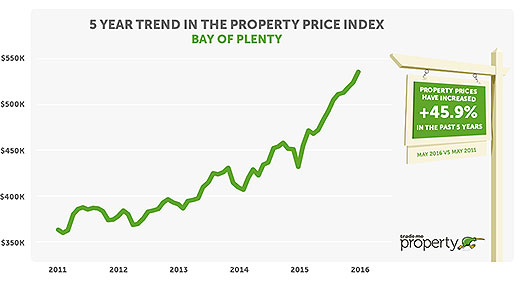

'But the Bay of Plenty is fast becoming the new kid on block, challenging Auckland and clocking up a 23 per cent asking price increase since May last year and up more than $100,000 for the first time. Looking further back, prices in the Bay have jumped 46 per cent over the past five years.”

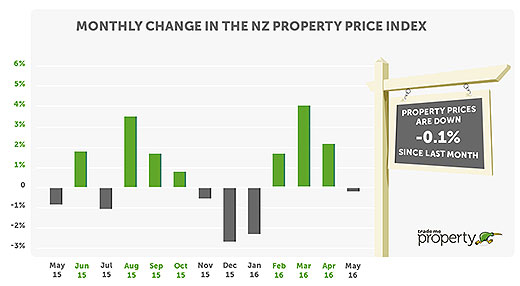

The national average asking price fell a microscopic 0.1 per cent on April to $584,400, but still up 9.2 per cent on 12 months ago – an increase of $49,150 per annum. Average asking prices have leapt 46 per cent over the past five years.

'We saw a similar month-to-month downturn in the national property market in November last year, largely triggered by the Reserve Bank's shifting controls of mortgage lending,” says Nigel.

'This recent shift comes at the same time as reductions in interest rates, which are usually an accelerant of property prices so we don't expect this unusual situation to continue.”

The average asking price in Auckland rose $95,100 to $842,550 in the year to May 2016, but slipped back 0.1 per cent on last month.

Significant regional diversity

Nigel says regional average asking prices were a mixed bag, with five regions with falls year-on-year and six with double-digit growth.

'It was a bit patchy around the grounds in May, with Hawke's Bay and Bay of Plenty leading the pack with increases of more than 23 per cent. Meanwhile, prices in Gisborne and Taranaki were the biggest droppers, down 5 per cent and 8 per cent respectively.”

Hawke's Bay and Bay of Plenty grew steadily over the past few months, potentially driven by Auckland investors seeking opportunities. 'Lower average property prices makes it easier to get a foot on the property ladder, but in turn this activity heats the market up and leads to increases in average asking prices.”

Elsewhere, Canterbury, Southland, West Coast, Gisborne and Taranaki saw a dip in average asking prices.

'Taranaki's house prices saw an 8 per cent fall, and the region seems to be suffering from a steady down-cycle. It's a marked change from a year ago when average asking prices surged up by 23 per cent.”

Investment properties in high demand

Nigel says 1-2 bedroom houses were a hotspot.

'These smaller and cheaper properties appeal to investors as lower-entry deposit options, and we're seeing a big lift in average asking price as a result. It broke $400,000 for the first time, up over 14 per cent on the previous year to a new high of $402,150.”

The Wellington market for smaller houses has gathered steam over the past eight months, with the average asking price up from $289,100 in September 2015 to a new record high of $368,800 in May 2016 – an increase of more than $10,000 per month.

This eclipsed Auckland where the average asking price rose from $602,450 in September 2015 to a new record high of $648,500 in May 2016, a monthly increase of $5,750.

Units in vogue with investors

Excluding Auckland, the national average asking price for units hit a record high in the three months to May, up 6.5 per cent on the previous year to $301,850.

'With investors piling in and snapping up lower-priced properties, unit prices are rising fast across the main urban regions. Bay of Plenty again leads the way with a 26 per cent lift on last year to land at $334,000. Auckland broke another record, up 15 per cent or $75,000 to $585,050 in just 12 months,” says Nigel.

Waikato saw average asking prices for units up 18.6 per cent to a new record, passing the $300,000 barrier to $303,500, while Wellington was up 11.8 percent on a year ago to $307,350.

3 comments

I'm RICH!!

Posted on 27-06-2016 12:01 | By Chris

Awesome, my home I've owned for just 6 years has SKY ROCKETED in price, I'm rich!! Of course, I can't sell the house, because I still have to live somewhere. But the good news is I can borrow on my new-found equity and buy a boat! Sure, friends of mine not yet in the market now have a lot of catching up to do, but I'll have a boat! And maybe a trip to Europe!

Yeah

Posted on 27-06-2016 18:02 | By overit

here come the rates increases too.

@overit

Posted on 27-06-2016 23:41 | By jed

You are mistaken that rates must rise because of house price increases.The total budget required to run Tauranga does not change just because house prices increase by 100k. In fact, it is entirely likely that some house owners will pay lower rates!!! It is a 0 sum game.You have losers and winners.

Leave a Comment

You must be logged in to make a comment.